Case studies

Central Southport, Sefton, Merseyside: Resident-led Enquiry on Debt Advice and Support

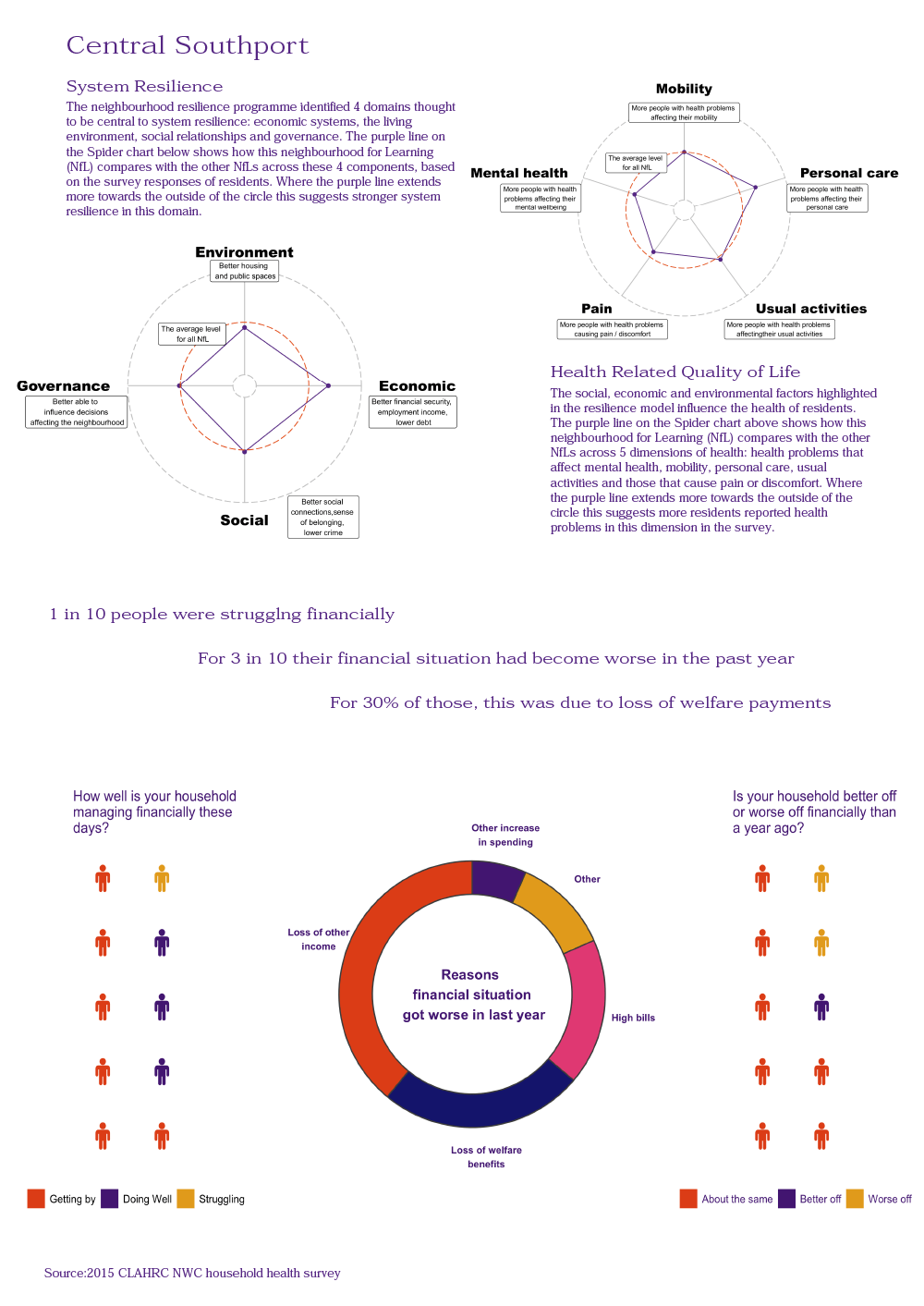

In Central Southport, the neighbourhood system players brought together in the NRP focussed their work on two aims. The first was to find ways of improving local, debt advice services; and the second was to expand personal finance and debt literacy in the local area. To inform the pursuit of these aims, the Local Oversight Group designed and completed two resident-led enquiries.

Improving debt advice services with a focus on their availability and accessibility

Debt advice service audit

The first enquiry focussed on identifying the existing, local providers of debt advice, visiting them and collecting information with a view to supporting them to identify ways of improving the reach and accessibility of their services. Six Resident Advisers, in partnership with the Academic Lead, conducted this audit, in March 2017, in the form of a ‘mystery shop’ exercise.

Identifying the organisations

Firstly, debt advice services were identified and listed on the basis of the Resident Advisers’ experiential knowledge, information provided by the local authority, by Sefton CVS and other stakeholders, and information obtained through web searches (using Google Search). Nine organisations were identified as being potentially relevant to the enquiry because they were themselves providing debt advice or because they provided related services and would signpost people to other debt advice services. The list of organisations to visit as part of the audit was derived from this initial list by excluding those organisations that only provided advice on housing or welfare benefits, those whose services were delivered exclusively over the phone, those without an office or other premises within the Neighbourhood for Learning boundary and those whose opening times forbade peer researchers from visiting. The five remaining services were located on a map of the area.

Conducting the field research

Resident Advisers, in pairs, visited these local debt advice agencies on 14 March 2017, between 1.30pm and 2.30pm, and collected information on the range of services on offer on a template document in the form of a notes booklet designed for this purpose. The booklet acted as an ‘aide-mémoire’ and included prompts about the types of information that peer researchers might decide to collect. The prompts were not overly prescriptive so as not to unduly constrain the information peer researchers might consider relevant and of importance. The prompts referred to the scope of the advice services offered; the gaps in the services offered; whether one service signposted to other services, and local people’s opinion of the service. The template encouraged the peer researchers to record their own views about the service, their suggestions for improvement, any key lessons they identified in their visit and their experiences of conducting this piece of field research.

After the visits, peer researchers came together with the academic lead person to discuss their findings, collate field notes, identify areas of improvements and recommendations and agree on key points to communicate to the LOG through a briefing report.

Key findings and recommendations

The briefing report’s key findings centred on the availability and accessibility of debt advice and relevant information. A selection of key findings is offered below:

- Clarity in the range of advice and support offered varied considerably between organisations. Clarity around service provision was considered very important by residents for avoiding delays in accessing debt advice.

- The opening times of different services varied considerably. A number of organisations operated limited opening times and few services provided any kind of service in the evenings.

- Not all organisations visited on the day were able to offer advice regarding translation services for people who might need them.

- One service offered access to a free phone for contacting other agencies. This was noted as an example of good practice.

- Residents agreed that continuity of adviser, when a person contacted an agency multiple times, conferred a number of benefits: helping to build trust; avoiding the need to repeat information over and over again; and, helping understand the complexity of a person’s circumstances.

A selection of the report’s key recommendations for debt service providers is offered below:

- Make registration/assessment forms available in languages that reflect the languages used locally.

- Keep websites updated especially with regards to contact information.

- Extend opening hours or the times available to book an appointment into the evening.

Influencing local services

Southport Money Advice Group (SMAG; the name of the Local Oversight Group), bringing together the findings of the service audit, a rapid evidence review on the topic of ‘Vulnerability to Debt’ produced by CLAHRC North West Coast, and Resident Advisers’ experiential knowledge, produced recommendations for local debt advice providers.

The group produced a summary information sheet intended for debt advice providers to put on their notice boards.

Debt advice providers were advised to make their services more easily available to people in employment. Accordingly, Citizens’ Advice extended their customer offer and started running a weekly drop-in session between 3.30pm and 7.30pm. From 2018 onwards, Beacon Counselling Trust started delivering free counselling advice to individuals and families affected by problematic gambling.

Sefton Council said they would like to talk to LOG members about redesigning the financial advice ‘Money Matters’ pages of the Sefton Directory website to provide more accessible information for non-specialist staff and for local residents who were experiencing financial difficulties.

Restricting access to payday loan websites

As a direct result of the LOG’s work, access to high-interest, ‘payday’, loan websites from computers at local libraries was blocked.

Expanding personal finance and debt literacy

Learning about personal finances, debt and gambling risk in the local school curriculum

To explore the contribution of school education to personal finance literacy, Resident Advisors and the Academic Lead arranged to have discussions with representatives from two local schools in March and April 2018. The group worked jointly in a preparatory session with a focus on undertaking qualitative interviews. At the meetings with the school representatives, the Resident Advisers took notes and, subsequently completed a thematic analysis of their notes, identified key messages and communicated them to the LOG. This work eventually led to the development of an intervention for school-age children.

Theatre-based workshops in local schools: learning about the risks of gambling and about the help and support that are available

The group made a successful application to the Community Fund of the England Illegal Money Lending Team (IMLT: stoploansharks.co.uk) for a grant to deliver a drama-based workshop in local schools. The purpose of the workshop was to alert pupils, teachers and administrators to the dangers of gambling and borrowing from ‘loan sharks’; to inform them of the signs of gambling addiction, and to make them aware of available supportive services.

The workshop comprised a monologue delivered by an actor followed by an interactive session with the audience. Leaflets with the contact details of debt advice services were distributed at the workshop. In terms of their reach, it was estimated that these workshops were attended by six hundred young people in the area.

PRODUCTION OF A SHORT FILM

A collaboration between the Migrant Workers Sefton Community, the England Illegal Money Lending Team, Sefton Council and Handstand Films resulted in the production of a short film warning of the dangers of borrowing money from ‘loan sharks’. Available in six languages, this video can be viewed on Vimeo: https://vimeo.com/161895506

Developing personal finance literacy

The Southport Money Advice Group (SMAG) organised the delivery of training on financial literacy and on supporting victims of illegal money lending.

Resident Advisers were able to attend diverse training opportunities including the Cash Smart Credit Savvy course delivered by Network Together Liverpool/CUF UK, and a Universal Credit briefing session delivered by the local office of the Department for Work and Pensions (DWP).

The volunteers of a local migrant workers group (the MWSC) attended training by the IMLT on recognising and assisting victims of illegal money lending and on reporting illegal money lenders.

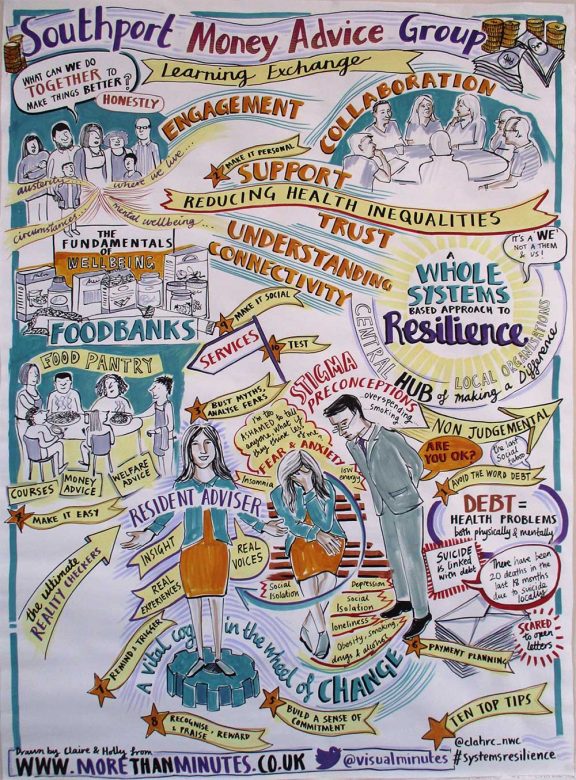

Money advice learning exchange event held on 27 March 2019 at the Lakeside Church in Southport

SMAG held a learning exchange event, titled ‘Lessons from a Neighbourhood for Learning in Southport’ inviting Resident Advisers, peer researchers, and professionals from the public and third sector (43 representatives from local organisations attended in total) to gather together and share knowledge and practice with the aim of improving services, policy and community health.

The event had three specific aims: to raise awareness about the impact of debt, including its impact on health; to help local agencies share information about their services with other organisations and the wider community; and to present the work of SMAG on indebtedness and financial challenges.

The event included a discussion around the ‘top tips’ offered by the Money Advice Service to debt advice service providers, and a ‘speed dating’ session where non-specialist staff from other organisations could meet with debt advice providers and find more about what they did. Presentations raised awareness of CLAHRC NWC, the NRP, explored the link between wealth and health, and highlighted local services and resources. Two video clips highlighted local issues – one delivered by a resident adviser. Visual minutes were produced to illustrate the themes covered. Comments from evaluation and ‘next steps’ forms were extremely positive and indicated that many had learnt something new during the event and some attendees indicated that they would be following up links established during the event.

Related Content

Related content

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla libero elit, viverra eget risus eu, posuere semper lorem. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla libero elit, viverra eget.

Related content

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla libero elit, viverra eget risus eu, posuere semper lorem. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla libero elit, viverra eget.

Related content

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla libero elit, viverra eget risus eu, posuere semper lorem. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla libero elit, viverra eget.