Case studies

Central Southport, Sefton, Merseyside

The neighbourhood

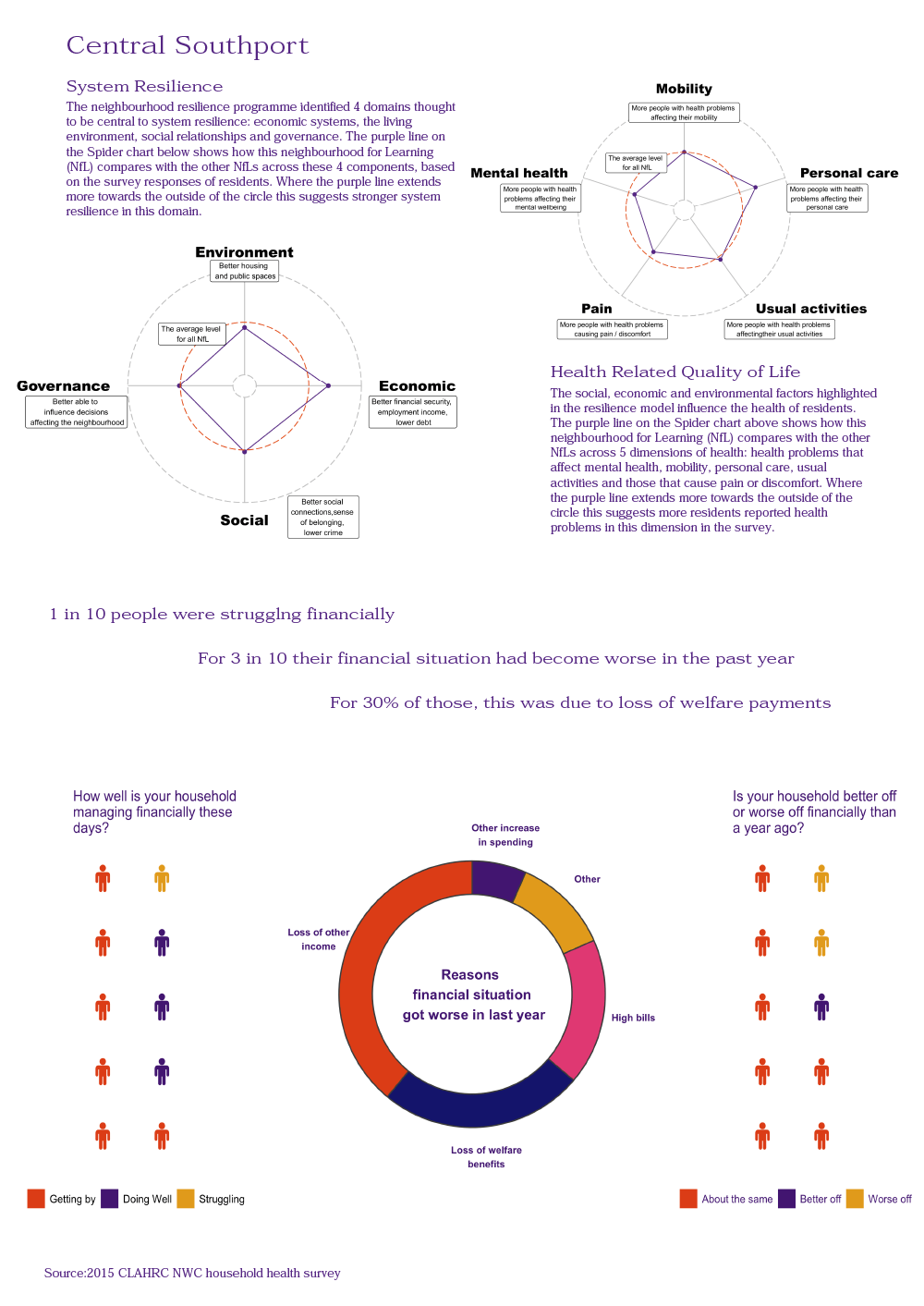

Southport is a Victorian seaside town in Sefton. It is an area of contrasts with pockets of affluence alongside considerable economic disadvantage. The main retail area has had many vacant properties reflecting the recent economic history. The NRP in Central Southport aimed to increase economic resilience by addressing issues around indebtedness and the support available to people facing personal finance challenges.

The neighbourhood players

The Local Oversight Group (LOG) in Central Southport was made up of local residents supported by the Sefton Council for Voluntary Services (the COREN organisation), Sefton Council and a number of other stakeholder organisations who contributed as and when their involvement was called for. Organisations that contributed to the LOG included the following: Citizens Advice, Christians Against Poverty, Migrant Workers Sefton Community (MWSC), Sefton Credit Union, Sefton Advocacy, and Southport College. Seven neighbourhood residents were registered as Resident Advisers in the lifetime of the programme.

The Local Oversight Group adopted the name Southport Money Advice Group (SMAG) because its focus was on personal and household indebtedness and their impacts on residents’ health and wellbeing.

Implementation: enhancing systems resilience

Bringing the system together

The Local Oversight Group organised a series of events in the neighbourhood between June and November 2016 to engage residents and other stakeholders in discussions about local concerns. From two events held in June 2016 and a local survey conducted by Sefton Council for Voluntary Services (Sefton CVS), the issue of debt was identified as an appropriate focus for the resilience initiative. One of the events, held in June 2016, was addressed at organisational system players. More than forty representatives from more than thirty organisations attended this event, including local councillors and third sector organisations. A further two events, held on June and November 2016, were addressed at local residents. Approximately, 25 residents attended the first event, and 23 (nine of which were of school age) the second one. These events further explored the issue of debt and issues around accessing debt advice services.

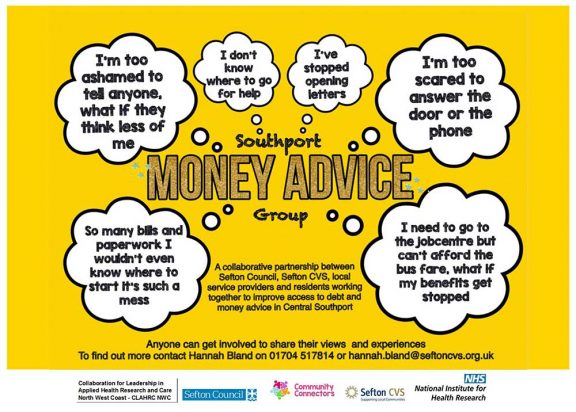

Surfacing local concerns

Financial difficulties and debt were highlighted by the participants in engagement events and by LOG members as having profound negative impacts on the community. A local survey conducted by Sefton CVS confirmed the local salience of the issue. Further, there were concerns raised that residents were not using the local services that could advise people struggling with money difficulties or signpost them to debt advice services. When they were accessing services, it would be after they had reached a point of crisis and emergency.

Mobilising knowledge

In light of the above, Resident Advisers conducted a local, participative enquiry to learn more about local debt advice provision and to identify activities that could begin to address local concerns. These activities centred on improving the following: signposting, access to advice and support services, and the provision of information and training relevant to indebtedness.

In response to local evidence needs, a rapid review on the topic of ‘vulnerability to debt’ was completed by the CLAHRC NWC for the LOG.

Mobilising knowledge continued and Taking action

Walk-about advice service audit

Six Resident Advisers conducted a ‘mystery shop’ exercise in March 2017. Firstly, debt service providers were mapped using Google Search, information from the local authority and local residents’ knowledge. Working in pairs, Resident Advisers visited local debt advice agencies to find out what they offered. Following the visits, residents came together to discuss their findings, collate field notes, and to agree on the key points to be included in the briefing report for the first LOG meeting. Resident Advisers presented their conclusions from this exercise at the inaugural meeting of the LOG. The information from this piece of work informed the overall focus of the NRP activity in Central Southport.

Debt, gambling and money management learning in the school curriculum

In March and April 2018, two group discussions were held with representatives from two local schools. The content of these discussions was fed back to the LOG and contributed directly to the development of an intervention targeted at local schools (see below).

Taking action

The actions taken as part of the NRP enhanced economic resilience by building capacity in debt advice in the area, raising wider awareness about personal debt and the problems it can cause, and increasing access to high quality advice and support. Training, secured through the NRP, enabled volunteers at a migrant workers group and Resident Advisers to be better able to support victims of illegal money lending. Awareness workshops targeted at local schools informed teachers, administrators and pupils about the signs of gambling addiction and about signposting others to available services.

School-based drama workshops: raising awareness of the dangers of gambling and sign-posting to advice services

A successful application was made to the England Illegal Money Lending Team (IMLT) – Stop Loan Sharks Community Fund for a grant to deliver a drama-based workshop in local schools. The purpose of the workshop was to highlight the dangers of gambling and borrowing from loan sharks. The workshop comprised a monologue delivered by an actor followed by an interactive session with the audience. Leaflets with the contact details of debt advice services were distributed at the workshop. In terms of their reach, it was estimated that these workshops were attended by 600 young people in the area.

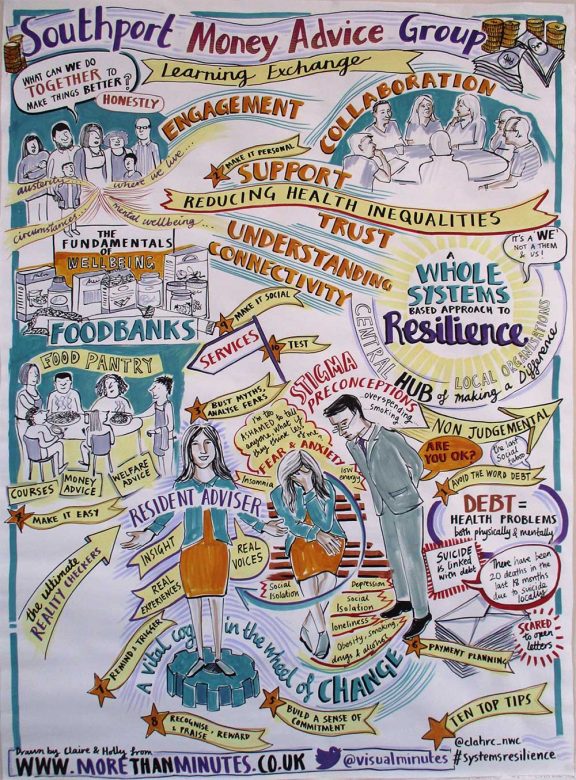

Money advice learning exchange event

In March 2019, SMAG held a learning exchange event with the following aims: to raise awareness about the impact of debt, including its impact on health; to help local agencies share information about their services with other organisations and the wider community; and to present the work of the LOG on indebtedness and financial challenges. The event included a discussion around the ‘top tips’ offered by the Money Advice Service to debt advice service providers, and a ‘speed dating’ session where non-specialist staff from other organisations could meet with debt advice providers and find out more about what they did. Visual minutes were produced to illustrate the themes covered.

Production of a short film

A collaboration between the Migrant Workers Sefton Community, the England Illegal Money Lending Team, Sefton Council and Handstand Films resulted in the production of a short film warning of the dangers of borrowing money from ‘loan sharks’. Available in six languages, this video can be viewed on vimeo: https://vimeo.com/161895506

Restricting access to payday loan websites

Restricting access to payday loan websites

As a direct result of the LOG’s work, high-interest, ‘payday’, loan websites could no longer be accessed from computers in local libraries.

Influencing debt and personal finances advice in the area

A summary information sheet was produced for debt services’ notice boards and advice service publicity was changed in the light of feedback from residents. Resident Advisers identified the need for services to make themselves more easily available to people in employment. Citizens’ Advice extended their customer offer and started running a weekly drop-in session between 3.30pm and 7.30pm. From 2018, Beacon Counselling Trust started delivering free counselling advice to individuals and families affected by problematic gambling.

The LOG organised the delivery of training on personal finances and financial literacy. Specifically, the LOG arranged for the volunteers of a local migrant workers group (the MWSC) to attend training by the IMLT on recognising and assisting victims of illegal money lending and on reporting illegal money lenders.

Further positive impacts linked to the NRP

Increased connections between residents and organisations in the area

Newly created links between residents and organisations enabled new knowledge flows between them. Resident Advisers shared their personal experiences on the matter with local organisations that provide advice on welfare benefits and personal finances.

In turn, Resident Advisers were able to attend diverse training opportunities including the Cash Smart Credit Savvy course delivered by Network Together Liverpool/CUF UK, and a Universal Credit briefing session delivered by the local office of the Department for Work and Pensions (DWP). In addition, residents received training through Sefton CVS to support their role as Community Champions for a Community Connectors project delivered by Sefton CVS.

Sefton Council said they would like to talk to LOG members about redesigning the financial advice ‘Money Matters’ pages of the Sefton Directory website to provide more accessible information for non-specialist staff and for local residents who are experiencing financial difficulties.

A member of the LOG attended two established forums in Sefton, the Southport Operational Group, and the Welfare Reform Action Group.

A public health consultant reported that the approach to resident involvement showcased by the NRP received a positive response from senior management within the local authority, including local councillors, and that this would be reflected in the then new Health and Wellbeing Strategy.

The Team

Nigel Bellamy – Lead for Sefton CVS

Hannah Bland – COREN Facilitator, Sefton CVS

Graham Perry – Strategic Housing Officer, Sefton Council

Fiona Ward – Academic Lead

Related Content

Related content

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla libero elit, viverra eget risus eu, posuere semper lorem. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla libero elit, viverra eget.

Related content

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla libero elit, viverra eget risus eu, posuere semper lorem. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla libero elit, viverra eget.

Related content

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla libero elit, viverra eget risus eu, posuere semper lorem. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla libero elit, viverra eget.